Safeguards retirement balances; helps grow wealth in favourable markets; protects against sequencing risk

AMP has launched MyNorth Guarantees, designed to protect and maximise nest eggs for the growing number of Australians nearing and entering retirement.

Amid continuing market volatility and sustained low interest rates, the offers can safeguard retirement balances from market downturns, while helping grow wealth when market returns are more favourable.

The new offers include:

- Partially guaranteed accounts that allow clients to hold guaranteed and non-guaranteed investments in the same account.

- A 5-year guarantee that protects investment in the MyNorth Guardian Max 85 Fund. This fund provides up to 85 per cent exposure to growth assets. Optional growth lock-ins secure growth achieved in the fund at each anniversary date.

- A 10-year guarantee that protects investment in the MyNorth Guardian Max 100 Fund. This fund provides up to 100 per cent exposure to growth assets. Growth lock-ins are a set feature, and vesting is optional. Vesting provides clients access to the guarantee benefit before the end of the term.

The offers are now available to clients and advisers through AMP’s MyNorth wrap investment platform.

AMP Australia’s Director of Wrap Products, Shaune Egan said:

“History tells us investment markets are unpredictable – the unforseen COVID-19 pandemic and ensuing impact on global share markets is the latest example.

“Those approaching or nearing retirement should be mindful of these possible downturns, which are increasingly impactful closer to retirement.

“If nest eggs aren’t protected from sequencing risk, the consequences for longevity of retirement savings, incomes and quality of life in later years can be significant.

“Another challenge for retirees is finding low-risk alternatives amid the diminishing yields from cash investments, given low interest rates. This can lead to investors taking an unacceptable level of risk to generate an adequate return to fund their retirement.

“We’ve designed the new MyNorth Guarantees to address these two issues – they provide the flexibility to safeguard against market downturns, while allowing clients to take advantage of market upside, and incrementally lock in positive returns.

“The offers reflect AMP’s commitment to helping our clients achieve their retirement goals, as we continue to invest in MyNorth as AMP’s flagship wrap investment platform.”

More information about MyNorth Guarantees is available here

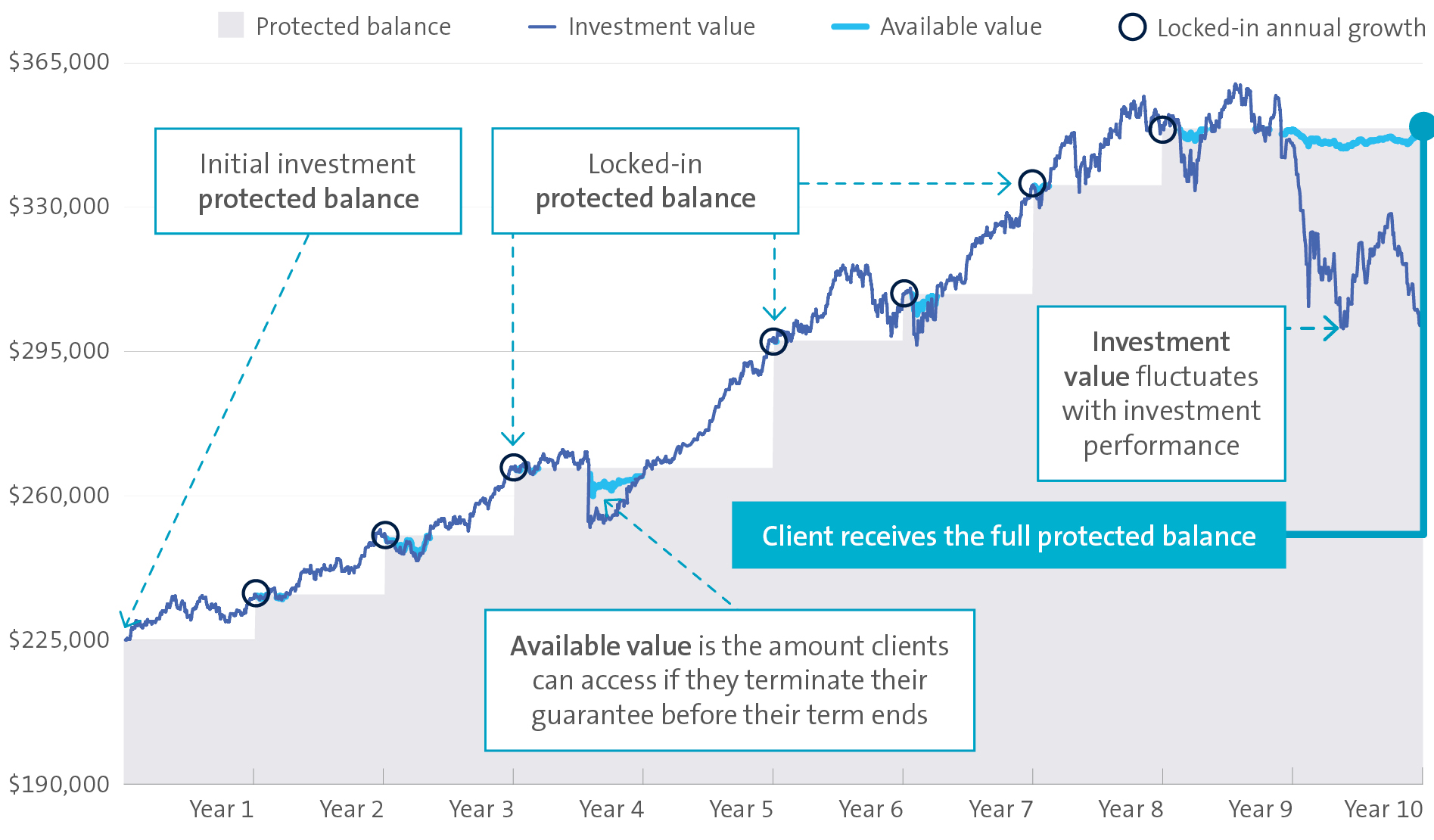

How the 10-year guarantee with optional vesting works to lock in balances and protect investments against sequencing risk, i.e. a market downturn at or near retirement:

This illustration does not account for the guarantee fees or tax liabilities attributed from the guaranteed investment over the life of the guarantee. The guarantee fee for the 10-year guarantee with vesting feature is 1.85%pa, based on the protected balance. While this hypothetical scenario illustrates a guarantee benefit payment at the end of the term, there are circumstances where the investment value will be greater than the protected balance at the end of the term and a guarantee benefit is not payable. This is for illustrative purposes only and not an indicator of actual performance or investment returns.