AMP’s MyNorth Managed Portfolios have grown to more than $1 billion in funds under management since launching in 2018.

The portfolios, which provide clients with access to 32 diversified portfolios managed by leading investment managers, have experienced strong uptake through both AMP’s aligned adviser network and independent financial advisers.

All MyNorth Managed portfolios clients benefit from professional investment management, the transparency and ability to track the performance of underlying assets on North Online, and ownership of the individual assets within their chosen portfolio.

They also allow clients to work with their adviser to select an investment option that reflects their own risk tolerance, enabling them to achieve their longer-term objectives, be it accumulation or income.

Shaune Egan, AMP’s Director Wrap Product, said the rapid growth of MyNorth Managed Portfolios reflects the quality of the underlying investment managers, their low-cost structure, and the ease through which they can be accessed and administered on the MyNorth platform.

“We’re delighted by the continuing strong demand for the portfolios and will continue to invest in MyNorth to ensure it provides advisers and clients with unrivalled investment options and administrative functionality,” said Mr Egan.

MyNorth’s partnered managed portfolio range continues to grow as AMP works with advice practices to develop portfolios tailored for their clients, and delivered with all the benefits that managed portfolios and the MyNorth platform offers.

The MyNorth Sustainable Managed Portfolio and IndexPlus series, are both recent additions to the portfolio range. The former is underpinned by a responsible and sustainable investment framework, while IndexPlus blends low-fee, low-turnover index-based investments with actively managed strategies.

Where clients are investing

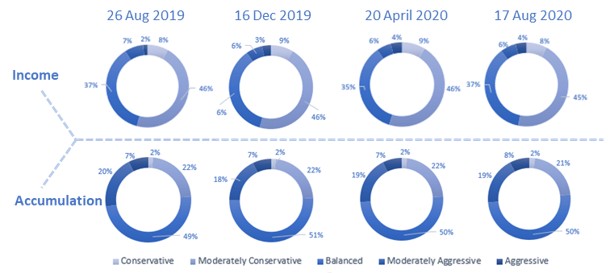

Analysis of AMP’s Research Choice Managed Portfolios, which represent almost 75 per cent of total funds under management across the portfolio range, shows clients have remained broadly consistent with their risk profiles, despite the market disruptions caused by COVID-19 this year.

Lakshman Anantakrishnan, AMP Australia’s Chief Investment Officer commented:

“For pension clients holding funds designed to provide income, the lower risk moderately conservative is the dominant risk profile chosen by clients. Clients have consistently held approximately 45 per cent of their funds within this asset class from August 2019 to August 2020.

“The only noticeable change for income focussed clients has been in the lightly held aggressive fund range, where clients have increased their holdings from 1.7 per cent to 4.2 per cent. This potentially reflects a measured approach to increasing yield through slightly more aggressive allocations to higher risk assets, within the context of a lower interest rate environment.

“For those clients in pre-retirement accumulation phase, where there is naturally greater appetite for risk, balanced has consistently remained the most dominant risk profile, with clients investing approximately 50 per cent of their funds in option.”

AMP Research Choice Managed Portfolios – total client asset class investment breakdown