While globally the COVID-19 pandemic has caused a huge economic shake up, it has also had far reaching impacts for Aussies in relation to their own personal finances. With this in mind, AMP has commissioned new research to unveil both the long and short-term impacts of the current crisis on everyday Australians – from day-to-day spending to major financial decisions including retirement, buying property and more.

The new research found that two-thirds of Australians (67 per cent) have had their finances impacted by COVID-19, with nearly half (49 per cent) of those surveyed predicting it will take at least three months to get their financial goals back on track.

AMP Bank, Director of Retail Solutions & Direct Distribution Michael Christofides commented:

“The pandemic has pushed more Aussies to think about their personal finances. With talks of the recession and consumer confidence down, it’s clear that many Australians have been impacted by COVID-19, including having to hold on making significant financial decisions from retirement to travel to buying property. We’re seeing Australians being more prudent with their saving and spending decisions, partially due to lockdown restrictions but also relating to a desire to be prepared for any future rainy days.”

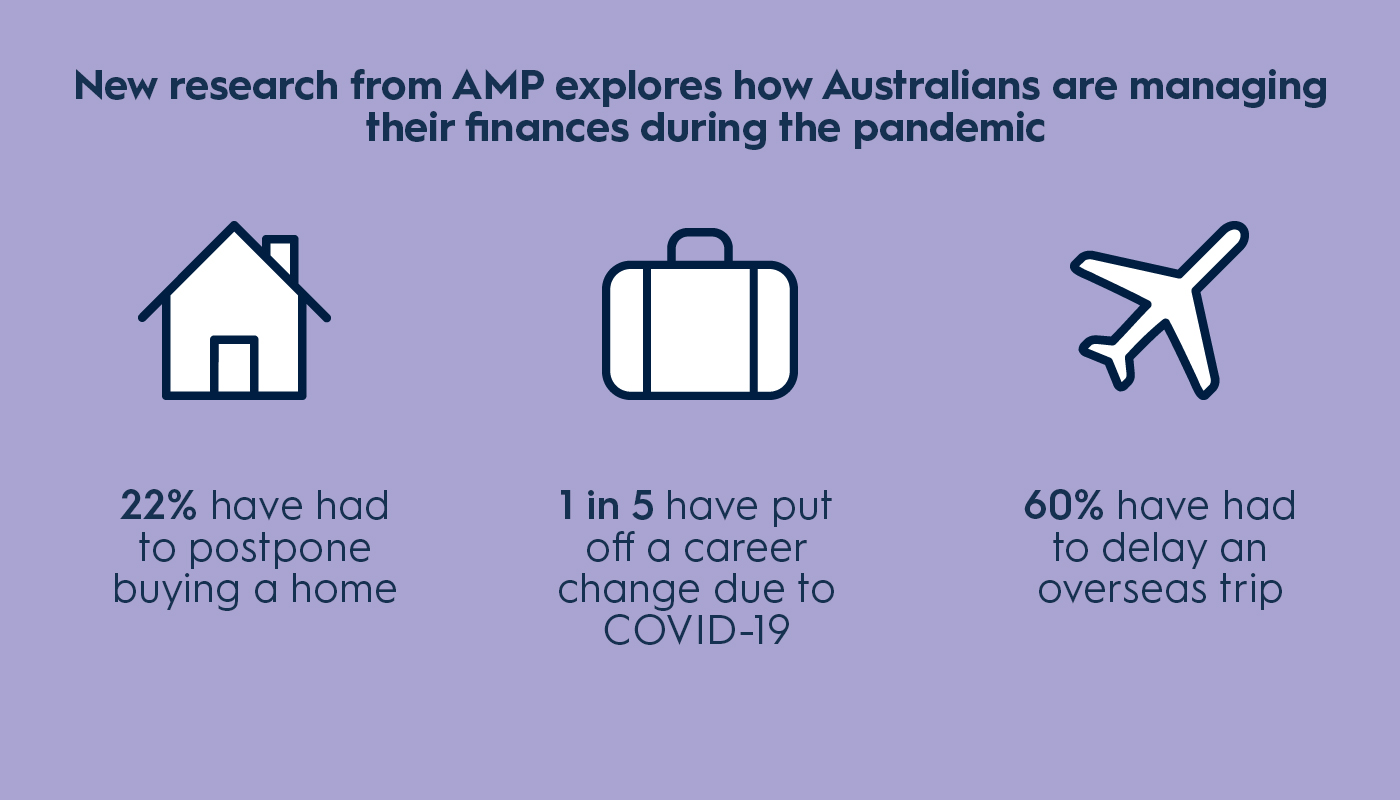

A key theme of postponing financial goals is clear in the new research, specifically:

- 60 per cent of Aussies have delayed an overseas trip;

- Nearly a third (29 per cent) have postponed buying a car while the same percentage have had to push back a major event such as a wedding;

- Approximately a quarter of Australians (22 per cent) have had to postpone buying a home as well nearly a fifth (19 per cent) having to hold off on buying an investment property;

- 1 in 5 Australians have put off a career change due to COVID-19.

Consumer spending has clearly taken a hit with recent statistics from the Australian Bureau of Statistics showing the steepest decline in sales volumes since the introduction of the goods and services tax (GST) in 2000. This is in line with AMP’s research which found that over a third (38 per cent) of Australians say they’ve cut back on spending across the board. In addition, a fifth of Aussies (21 per cent) noted they are spending less and putting more money towards saving and investing.

For those whose jobs were not impacted significantly by COVID-19, an increase in saving habits was also clear with nearly half of those surveyed (44 per cent) saying that they’ve been saving more money due to restrictions impeding Australians’ abilities to go out, socialise, travel and more.

Interestingly, while the COVID-19 pandemic has profoundly impacted how Australians live and spend, there is a hope of a silver lining with 39 per cent of Australians saying that while COVID-19 might have been a big shock, it’s given them the opportunity to plan for their futures and get their finances in order. Furthermore, 45 per cent of Australians are optimistic about their financial futures post COVID-19.

Christofides continues, “Now more than ever, Australians are conscious of the importance of saving and preparing for the unpredictable. There’s no doubt that COVID-19 has brought with it a number of challenges for Aussies but the challenging climate has given some the opportunity to take a step back and re-evaluate their personal finance journeys. Compared to earlier in 2020, there’s a sense that Aussies are taking this time to reset their financial goals and adopt more proactive financial behaviours both in relation to saving and discretionary spending.”

To help Australians better maintain their financial wellness and realise their individual goals, AMP has developed a COVID-19 Support Hub to help those affected by the pandemic navigate the ever-changing economic landscape on an individual level. For more information visit: https://www.amp.com.au/support/COVID-19

About the research

This research was commissioned by AMP and conducted by Pure Profile in August 2020. Over 1,000 (1,031) Australians between 18 and 65+ were surveyed on their spending and saving habits as well the impacts of COVID-19 on financial decision-making.