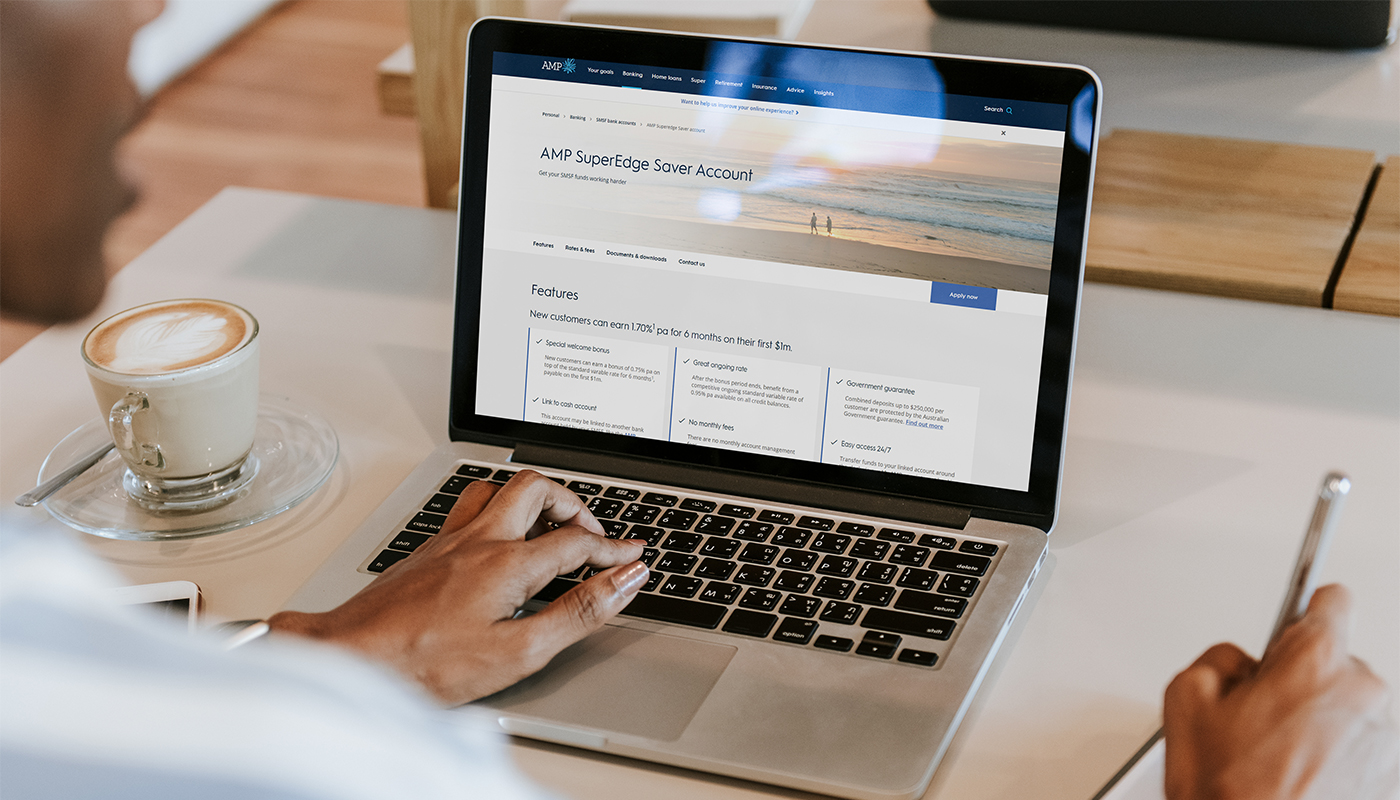

AMP Bank is continuing to invest in its digital capability with the launch of online applications for SMSF deposit accounts, including the award winning1 SuperEdge Saver.

AMP Bank Managing Director Rod Finch said both individual and corporate trustees can now apply for a new SMSF account online, making it a simple and efficient experience.

“We know SMSF trustees, often people with busy lives, really value an online and simple sign up process for the most competitive products, particularly in current times.”

SuperEdge Saver’s interest rate for new clients2 is one of the most competitive in the market at 1.70% p.a. variable rate, for six months for up to $1m in savings. The ongoing variable rate is 0.95% p.a.”

Mr Finch added: “Clients aren’t required to have a linked account with AMP Bank, so they can transfer funds easily between SuperEdge Saver and any external account held by the SMSF.”

“And, making the process even more efficient, is an ability to validate identification online, so for most applicants this means no need to send us copies of passports and trust deeds, eliminating another time-consuming task.”

“This is an important continuation of our ongoing investment in the Bank’s digital capability, allowing us to further strengthen the support and service we offer our clients, as well as our important broker and adviser partners.”

AMP Bank is the Mozo 2020 SMSF Savings Bank of the Year. Clients can apply for SuperEdge Saver online at amp.com.au.

The product issuer and credit provider is AMP Bank Limited ABN 15 081 596 009, AFSL and Australian credit licence 234517.

1 Canstar 5 Star Rating - Outstanding Value Savings and Transaction Account 2020

2 Clients who have not held an AMP SuperEdge Saver Account in the past two years will earn a bonus of 0.75% p.a. on top of the AMP SuperEdge Saver Account standard interest rate during the Bonus Period. The Bonus Period begins the first day of the month after the account is opened and is active for six months. The bonus rate is payable on account balances of up to $1 million per customer. The bonus rate and standard interest rate are both variable rates and correct as at 11 June 2020 but subject to change without notice.

It’s important to consider your circumstances and read the relevant Terms and Conditions before deciding what’s right for you. This information hasn’t taken your circumstances into account. Fees and charges may be payable.