Australians are set to benefit from a package of changes to superannuation from the start of the new financial year. The changes include an increase to the compulsory Superannuation Guarantee (SG), which will add thousands of dollars to retirement savings, particularly for younger Australians.

Low-income earners will benefit as they now will receive SG contributions from the first dollar of salary/wage income earned, with the current $450 per month exemption from compulsory SG contributions being removed from 1 July.

The removal of the work test from ages 67-75 and the reduction in the downsizer contribution age to 60 provides added flexibility for older Australians to boost their super balances prior to retirement. Further changes include an increase to the eligible funds for the first home super saver (FHSS) scheme and an extension to the 50 per cent reduction to minimum superannuation drawdown requirements for retirees.

Superannuation Guarantee increase

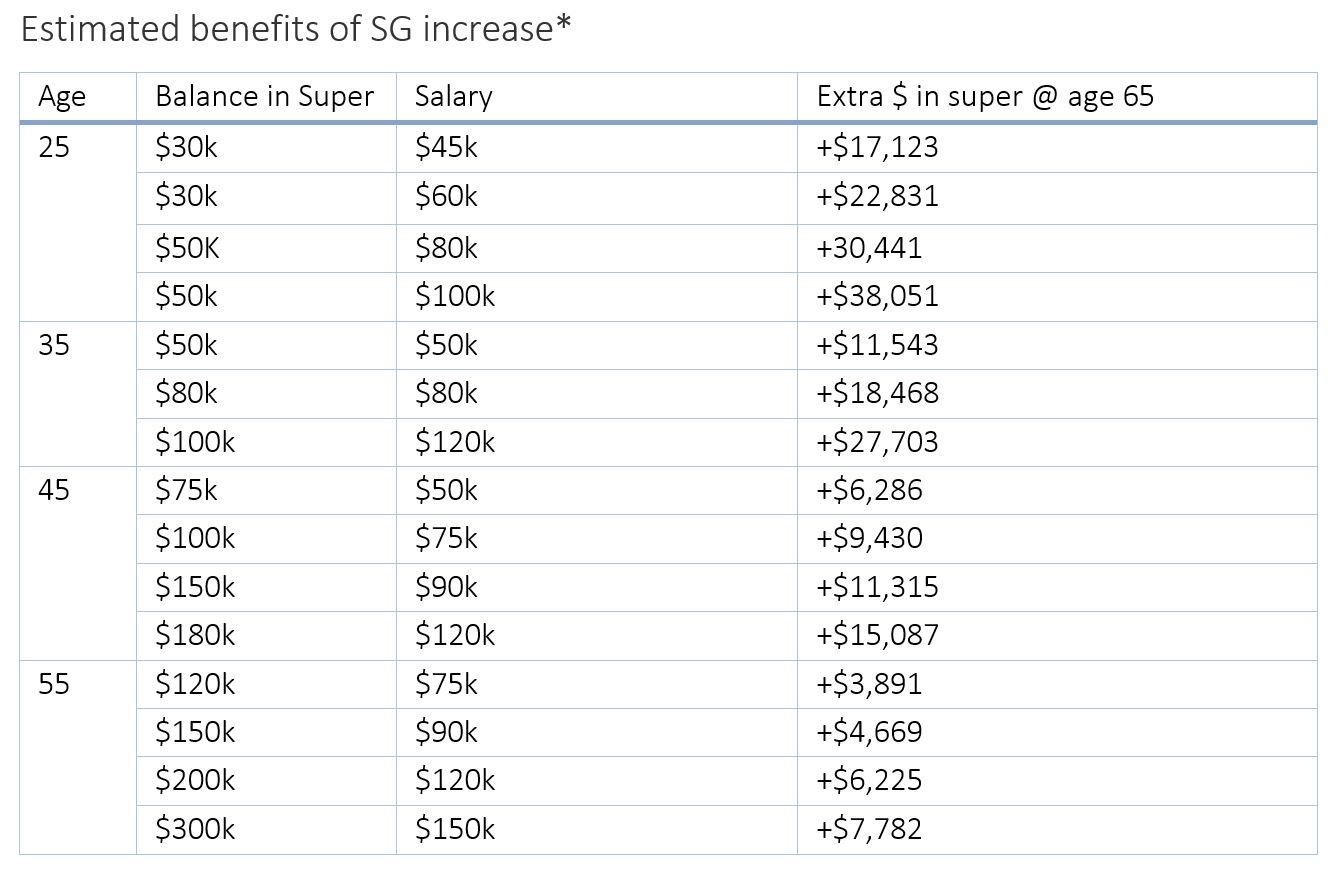

The mandated 50 basis point increase to the Compulsory SG from 10 per cent to 10.5 per cent, will increase retirement savings for a 25 year-old Australian with a salary of $80,000 per year and a current super balance of $50,000 by more than an estimated $30,000 at age 65. For a 55 year-old Australian with a super balance of $300,000 and salary of $150,000, the SG increase will add more than an estimated

$8,000 to their balance by age 65*.

John Perri, AMP’s Technical Director for Superannuation, commented:

“One of the fantastic things about our superannuation system is that Australians automatically benefit from the magic of compounding investment returns. What may seem like a relatively small addition to contributions in the short-term will magnify into meaningful savings at retirement. This is therefore a beneficial change for all working Australians, but particularly for younger Australians who will see a greater compounding effect over the long-term.”

Removal of Work Test from 67 to 75

Australians aged 67 to 74 (inclusive) will be able to make or receive non-concessional superannuation contributions or salary sacrificed contributions without meeting the work test, subject to existing contribution caps. These individuals will also be able to access the non-concessional bring forward arrangement, subject to meeting the relevant eligibility criteria.

John Perri commented:

“This change simplifies the rules governing superannuation contributions and will increase flexibility for older Australians to top up their nest eggs. Individuals aged 67 to 75 will now have a unique opportunity to be able to contribute for the first time, without having to meet the work-test, proceeds from an inheritance or the sale of an asset into their superannuation as non-concessional contributions. This will further boost their overall income in retirement.

“For example, Kate is age 70 and has not worked and has not contributed to superannuation for many years. She sells an investment property in August 2022 for $450,000. Under the current rules, Anjum is ineligible to contribute to superannuation. From 1 July 2022, she will be able to contribute up to

$110,000 into superannuation in the 2022-23 financial year, and then a further $330,000 in the 2023-24 financial year.”

Reduction in downsizer age to 60

Currently, contributions from home sale proceeds to super can only be made by Australians aged 65 or older. This age will be lowered from 65 to 60 from 1 July 2022.

John Perri commented:

“Individuals aged 60-64 will now have more flexibility in organising their financial affairs on selling their home, with the ability to contribute up to $300,000 of the sale proceeds into superannuation. This is in addition to the normal superannuation contribution caps.”

First Home Super Savers Scheme withdrawal increase

The amount of eligible contributions for Australians that can count towards maximum releasable amount for FHSS scheme will increase from $30,000 to $50,000. The eligible contributions that can count towards FHSS each financial year will remain at $15,000.

John Perri commented:

“This small change to the First Home Super Saver Scheme will further assist first-home buyers in using Australia’s superannuation system as a tax-effective way to save for part of their home deposit.”

50 per cent reduction in minimum pension payments

The 50 per cent reduction to minimum superannuation drawdown requirements for retirees, originally announced at the start of the Covid pandemic in March 2020, will be extended to 30 June 2023.

John Perri commented:

“Amid volatile investment markets, this decision helps in providing some stability for Australians managing their wealth in retirement.”

* Calculations use ASIC assumptions of investment return of 7.5 per cent per annum, 7 per cent tax on earnings, investment fees of 0.85 per cent per annum, a salary indexation rate and discount rate of 2.5 per cent per annum.

John Perri is one of Australia’s foremost experts on superannuation, with over three decades experience navigating complex superannuation rules and regulations. As AMP’s leading technical super manager John helps break down complex super law into a language, we can all understand. John’s aim is to educate Australians about the importance of engaging with their super to help build a better retirement.