AMP has delivered a return of 20 per cent, on average, for members of its AMP MySuper Lifecycle fund for the financial year ending 30 June 2021.

Those members under age 50, who are provided with a higher growth asset allocation, have achieved returns between 21.6 per cent and 23.8 per cent for the financial year. The returns are net of fees, and superannuation tax.

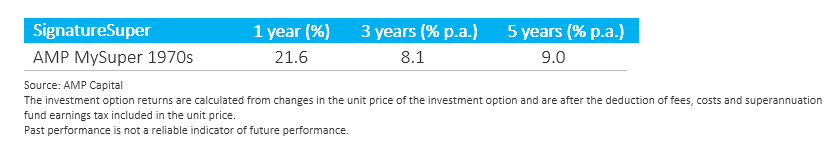

The largest group of AMP MySuper members are in the MySuper 1970s cohort, which achieved 21.6 per cent returns in the last 12 months and achieved 9.0 per cent annual returns over the past five years.

Scott Hartley Chief Executive of AMP Australia said:

“Delivering strong returns for our super members is a priority and this is an excellent result for AMP MySuper members.

“The returns demonstrate that AMP’s Lifecyle MySuper is working for members as intended.

“Our younger members – those born in the 1990s, 80s and 70s – have achieved returns as high as 23.8 per cent given their higher exposure to growth assets like shares, property and infrastructure.

“Our members closer to retirement, with lower exposure to growth assets to protect their super balance against market downturns, still achieved returns in excess of 11.9 per cent.

“Superannuation is a long-term investment, and while achieving returns of 20 per cent every year is unrealistic, our objective is to deliver consistently strong returns for all age cohorts, relative to the market and balanced with risk.

“The further simplification of our superannuation business and reduction in member fees we have delivered will further help us to achieve good outcomes for members into the future.”