AMP strategy

- New AMP strategy to create client-led, simpler, growth-oriented business.

- Strategy will reinvent wealth management in Australia, tackle legacy issues and position AMP Capital and AMP Bank for growth.

- Three-year, A$1.0 billion – A$1.3 billion transformational investment program to drive growth, reduce costs and de-risk the business.

- Cost reduction initiatives to deliver A$300 million of annual run-rate cost savings by FY 22.

- AMP culture to be client led, entrepreneurial and accountable.

- A$650 million capital raising to commence immediate delivery of new strategy ahead of proceeds from AMP Life.

1H 19 results

- 1H 19 underlying profit of A$309 million driven by earnings growth in AMP Capital and resilient AMP Bank performance.

- Impairments of A$2.35 billion (post tax) – predominantly non cash – taken to address legacy issues and position AMP for the future, leading to a 1H 19 net loss attributable to shareholders of A$2.3 billion.

- On track to complete client remediation program during 2021; previously-disclosed program remains in line with initial estimate including both aligned and salaried advisers.

- Level 3 eligible capital above minimum regulatory requirements (MRR) is A$1.7 billion at 30 June 2019.

- The AMP Board has resolved not to declare a first half 2019 dividend. The board will maintain a consistent approach to capital management until the completion of the sale of AMP Life.

Management update

- AMP Chief Financial Officer (CFO) designate John Patrick (JP) Moorhead has decided to leave the group to pursue other opportunities.

- James Georgeson, currently AMP Deputy CFO, has been appointed to the role of Acting CFO and will immediately commence handover with retiring CFO Gordon Lefevre.

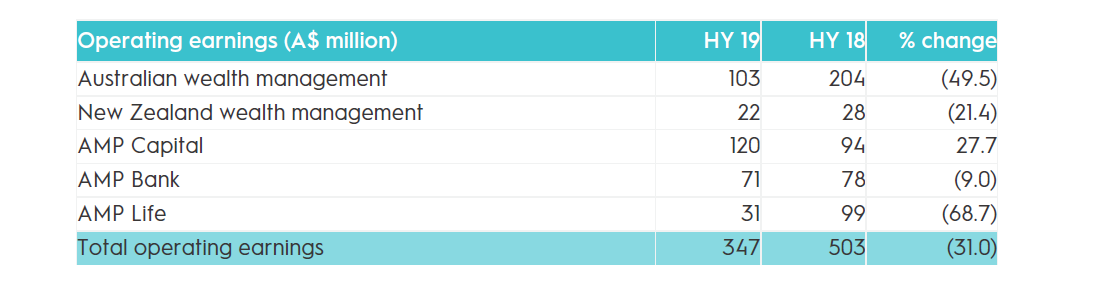

Business unit results

Australian wealth management

Australian wealth management (AWM) reported operating earnings of A$103 million (1H 18: A$204 million) in a challenging and competitive environment. The business continued to improve client outcomes including MySuper and MyNorth fee reductions.

Operating earnings were impacted by:

- Six-basis-point margin compression from MySuper fee reductions, advisers moving clients to contemporary solutions and the removal of earnings transferring with AMP Life.

- The removal of internal distribution arrangements with AMP Life.

- Higher controllable costs due to the reporting of regulatory and compliance project costs into business unit controllable costs as well as higher project and IT costs.

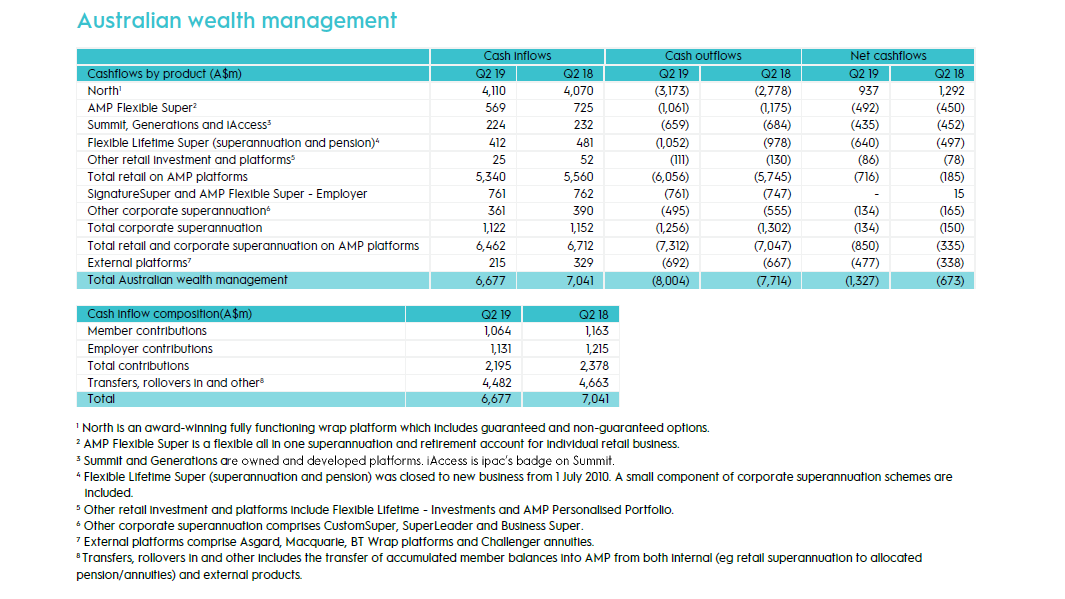

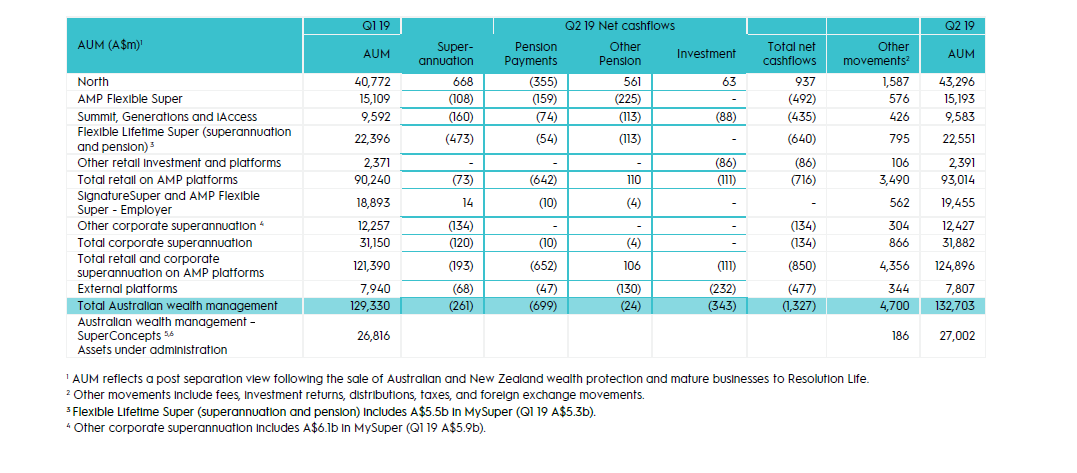

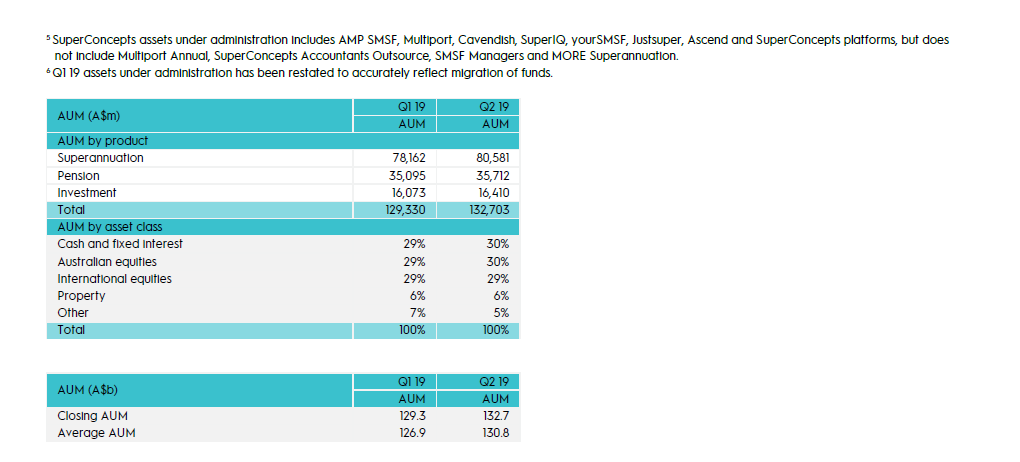

AUM closed 8 percentage points higher at A$132.7 billion, largely driven by stronger investment markets. This increase occurred despite ongoing weakness in net cashflows.

Net cash outflows of A$3.1 billion in 1H 19, including A$1.2 billion in pension payments to support clients in their retirement, were consistent with 2H 18. Net cash outflows were primarily due to lower inflows and elevated outflows. This reflected ongoing reputational impacts and adviser focus on client retention although signs of improvement emerged towards the end of the half.

Total corporate superannuation AUM of A$31.9 billion in 1H 19 increased 7 percentage points from FY 18, largely driven by stronger investment markets. Net outflows were higher (1H 19: A$418 million; 1H 18: A$167 million) but AMP retained the significant majority of large corporate super mandates despite an increase in the number of employer reviews.

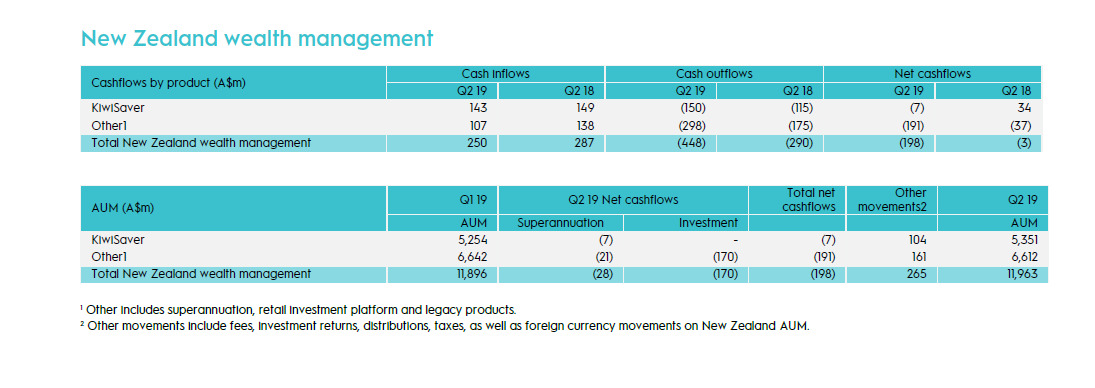

New Zealand wealth management

New Zealand wealth management delivered a resilient performance in the face of increased competition. New Zealand wealth management reported lower operating earnings of A$22 million in 1H 19 (1H 18: A$28 million), with the decline mainly due to the removal of product revenues transferring with AMP Life. On a comparable basis, operating earnings were steady.

Average AUM increased to A$11.7 billion (1H 18: A$11.1 billion), reflecting positive investment markets. Net cash outflows of A$250 million in 1H 19 (1H 18: A$50 million net cash inflows) were the result of increased competition in the market, regular retirement withdrawals and first home buyer withdrawals. KiwiSaver continues to generate positive cashflows.

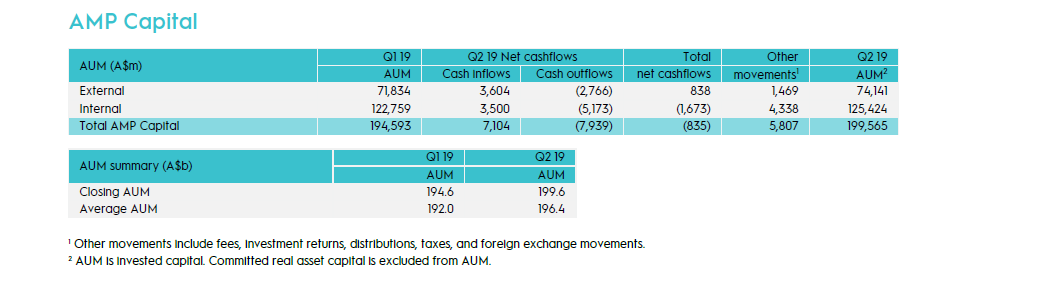

AMP Capital

Solid real assets growth and continued global growth drove a strong 1H 19 performance at AMP Capital, with operating earnings of A$120 million (1H 18: A$94 million). Factors contributing to the growth included:

- Increased real asset AUM revenue.

- Higher transaction fees including one-off profits on the sale of the AA-REIT management entities.

- Increased valuations of AMP Capital’s sponsor stakes in its infrastructure funds.

Ongoing global investor interest in infrastructure contributed to positive external net cashflows of A$818 million (1H 18: A$1.6 billion). Total net cash outflows of A$2.6 billion (1H 18: A$1.5 billion) were driven by internal cash outflows.

AMP Capital’s real assets investment pipeline currently includes A$5.1 billion of funds raised but not yet invested (and are therefore not reflected in 1H 19 numbers), with A$2 billion earmarked for committed transactions.

Controllable costs increased to A$239 million (1H 18: A$215 million); AMP Capital continues to target a full-year cost to income ratio of 60 to 65 per cent amid ongoing growth.

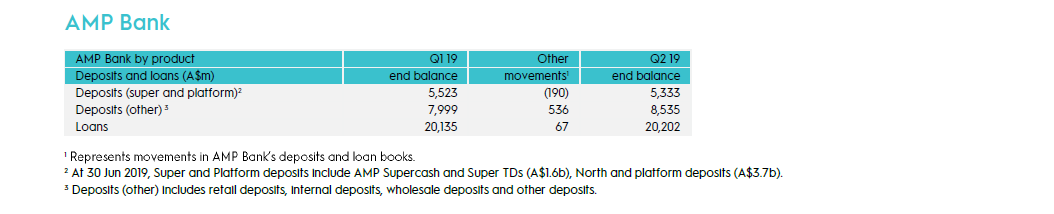

AMP Bank

AMP Bank delivered continued mortgage and deposit growth in a slower housing market. Operating profits of A$71 million (1H 18: A$78 million) were driven by residential mortgage book growth, offset by higher regulatory and compliance project costs for implementing major change, now reported in controllable costs from 1H 19.

The total loan book grew to A$20.2 billion while deposits increased by 9 per cent to A$13.9 billion during 1H 19 (1H 18: A$12.7 billion). This reflected increased term and at-call deposits and was part of AMP Bank’s strategy to move towards a more deposit-funded bank. Net interest margin was resilient despite increased funding costs and the competitive lending environment.

AMP Life

The 1H 19 result for AMP Life was significantly impacted by the Protecting Your Super legislation in Australia. Operating earnings of A$31 million (1H 18: A$99 million) were also impacted by best estimate assumption changes and the cost of higher levels of reinsurance in New Zealand wealth protection. Profit margins decreased to A$116 million (1H 18: $143 million).

Experience and capitalised losses of A$85 million (1H 18: A$44 million loss) were driven by an increase in income protection and total permanent disability claims in Australia and Protecting Your Super impacts.

Client remediation

AMP is on track to complete its previously-disclosed remediation program during 2021 and remains in line with the initial estimate of A$778 million including both aligned and salaried advisers.

The amount provisioned – as part of the total estimate – has increased by A$16 million to A$672 million reflecting additional lost earnings and program costs recognised during the half. Total program spend (including program costs and money repaid to clients) is A$60 million to date. The program has been designed to scale and accelerated considerably during 1H 19. It will continue to accelerate during 2H 19.

The program scope and AMP’s major remediation policies have been agreed with ASIC. The expense and provisions associated with the program are subject to external audit review every six months as part of AMP’s financial reporting.

Impairment

During 1H 19, AMP recognised a predominantly non-cash impairment of A$2.35 billion (post tax) to write down goodwill in AWM and AMP Life, capitalised project costs and valuations of advice registers given changes to buyback terms also announced today and associated practice finance loans. The impairment addresses legacy issues and positions AMP for the future, with an approximate capital impact of A$139 million (post tax).

Capital position and dividend

AMP’s level 3 eligible capital above minimum regulatory requirements (MRR) is A$1.7 billion at 30 June 2019, up from A$1.65 billion at 31 December 2018. This level of capital is in line with the AMP Board’s target surplus requirements. The target surplus is in place to protect the adequacy of the capital position by maintaining a sufficient surplus to reduce the risk of breaching the MRR reflecting accepted industry and prudential standards.

The AMP Board has resolved not to declare a first half 2019 dividend. The board will maintain a consistent approach to capital management until the completion of the sale of AMP Life.

Post the sale of AMP Life and the capital raising announced today, the proforma eligible capital above MRR is expected to be A$2.6 billion, with a large reduction in MRR once AMP Life is no longer part of the Group.

AMP anticipates that the excess above target surplus will first be used to fund delivery of the new AMP strategy. Beyond this, AMP will assess all capital management options with the intent of returning the excess above target surplus to shareholders, subject to unforeseen circumstances.

Following the completion of the sale of AMP Life, the Board intends to target a dividend payout ratio of 40-60 per cent of net profit after tax adjusted for non-cash items. The payment of any dividend will remain subject to the performance of the group and progress against the new strategy.

More detailed information on the 1H 19 result is available in the 1H 19 investor report and presentation, both accessible at amp.com.au/shares.

Strategy

AMP has announced its three-year strategic plan to transform the business into a simpler, client-focused business that is higher growth and higher return. Under the strategy, AMP will:

- Divest majority ownership in AMP Life to release capital and further localise New Zealand wealth management, exploring options to divest.

- Reinvent wealth management in Australia, helping clients realise their ambitions.

- Grow contemporary solutions in Australian wealth management including shifting focus to direct-to-client channels and digital solutions.

- Further integrate AMP Bank solutions with wealth management, continuing strong growth;. target double-digit earnings growth over medium term.

- Fix legacy issues in Australian wealth management including reshaping aligned advice (buyback changes; fewer, more productive advisers), simplifying super.

- Grow AMP Capital through differentiated capabilities such as in real assets and public markets, pursue international growth opportunities.

- Continue to expand global footprint in real assets, growing customised solutions.

- Build on strong relationships in China, Japan, US; explore opportunities to expand real asset and global equity capabilities into international markets.

- Double-digit earnings growth over the medium term through the cycle.

- Reinvigorate AMP culture to be client led, entrepreneurial, and accountable, with effective management of financial and non-financial risk.

The strategy will be supported by a focussed and disciplined A$1.0 billion – A$1.3 billion program to invest in transformation.

- Investing in growth (A$350–A$450 million investment).

- Realising cost improvement (A$350–A$450 million investment).

- Delivery of A$300 million annual run-rate cost savings by FY 22.

- Tackling legacy issues by de-risking the business (A$300–A$400 million investment).

Management update

AMP announces that its Chief Financial Officer (CFO) designate, John Patrick (JP) Moorhead, has decided to leave the group to pursue other opportunities.

James Georgeson, currently AMP Deputy CFO, has been appointed to the role of Acting CFO and will immediately commence handover with retiring CFO Gordon Lefevre. Mr Georgeson will formally transition into the role by 1 October 2019.

Mr Georgeson was appointed Deputy Chief Financial Officer of AMP in June 2018, with responsibility for AMP’s group performance reporting, strategic planning and forecasting, portfolio and capital management and AMP’s mergers and acquisitions functions. Since joining AMP in 2001, Mr Georgeson has held senior finance positions across the group including: Chief Financial Officer (Wealth Management), Director of Group Finance, Chief Financial Officer (AMP New Zealand), Chief Risk Officer and Director of Strategy (AMP New Zealand).

AMP would like to thank both Mr Lefevre and Mr Moorhead for their significant contributions to AMP.

AMP has commenced an executive search process for a new Group CFO.

Important information

This announcement is being issued contemporaneously with other announcements by AMP. This announcement is subject to the same “Important Notice” as appears on slides 56 to 58 in the 2019 half year results and AMP strategy presentation dated 8 August 2019 with any necessary contextual changes. The securities mentioned herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), and may not be offered or sold in the United States absent registration or an exemption from the registration requirements of the U.S. Securities Act.

Important information

The information on this page was current on the date the page was published. As a result of changes to the business from time to time, including changes to product, product issuer, services, trust, trustees and other entities, the information may no longer be current. For up to date information, we refer you to the relevant product disclosure statement and product updates.